》View SMM Silicon Product Prices

》Subscribe to View Historical Price Trends of SMM Metal Spot

The silicon metal market continues to fluctuate downward, with market sentiment also having a certain degree of impact on the upstream raw material segment. During the previous period of rapid capacity expansion in the silicon metal industry, raw silica also benefited from a significant surge in demand. However, this year, due to sustained losses in the silicon metal market, production enthusiasm among manufacturers has generally been low. Under this sentiment, the raw silica segment is also expected to face certain unfavourable factors in demand in 2025.

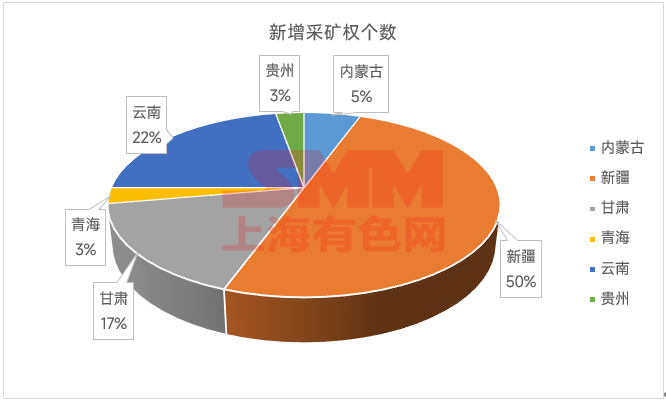

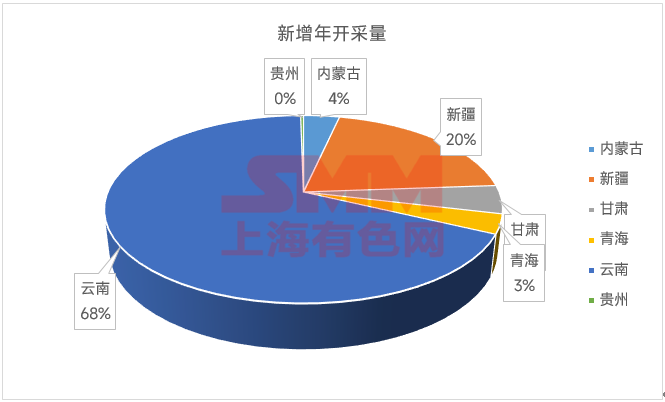

According to statistics from the mining rights registration information of the Natural Resources Bureau, there were 19 newly established metallurgical quartzite mining rights in China in 2024 alone. Based on the production scale designed for each mining right, it can be calculated that the annual production of metallurgical silica in China could increase by as much as 16.5337 million mt. Compared to the 17 newly established mining rights in 2023, which added a total of 19.381 million mt, the annual production increase has slowed, but the number of mining rights continues to grow. Over the two years from 2023 to 2024, China added a total of 36 new metallurgical quartzite mining rights, with an annual production increase of as much as 35.9147 million mt.

Although as many as 60 metallurgical silica mining rights were canceled during these two years, most of the canceled mines were small mines with an annual production of less than 100,000 mt. As a result, the cumulative reduction in annual silica production was only 4.098 million mt. Calculations show that the net increase in annual metallurgical silica production from 2023 to 2024 was 31.8167 million mt. Although not all of these metallurgical silica resources are used exclusively for silicon metal smelting, with some going to other consumption channels such as ferrosilicon, the overall trend of increased supply of upstream raw silica for silicon metal remains unchanged.

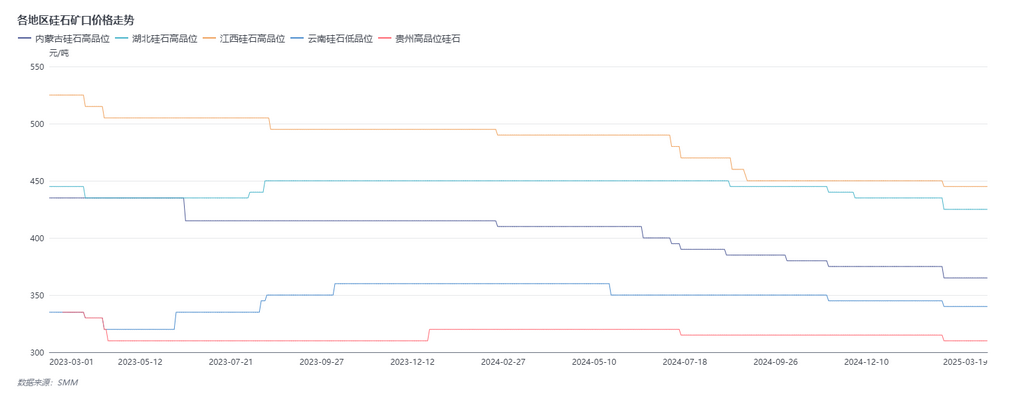

As mentioned earlier, the silicon metal market has been weak for a long time. With prices fluctuating downward throughout 2024 and continuing to weaken in 2025, raw silica prices have also been affected. Although the price decline has not been significant, overall, prices have shown a loosening trend over the past two years. Coupled with the increasingly abundant silica supply and the shrinking demand for externally purchased silica as large plants secure more silica mine resources, some silicon metal manufacturers have started selling their own silica externally to offset losses in silicon metal production. In previous years, March-April was the period when silicon metal manufacturers in south-west China concentrated on procuring raw materials in preparation for production resumption during the rainy season. However, due to silicon prices consistently operating below the cost line for small and medium-sized manufacturers, combined with the current uncertainty in rainy season electricity prices and other factors, production resumption plans for silicon plants in south-west China this year are highly unclear, leading to delays in raw material replenishment.

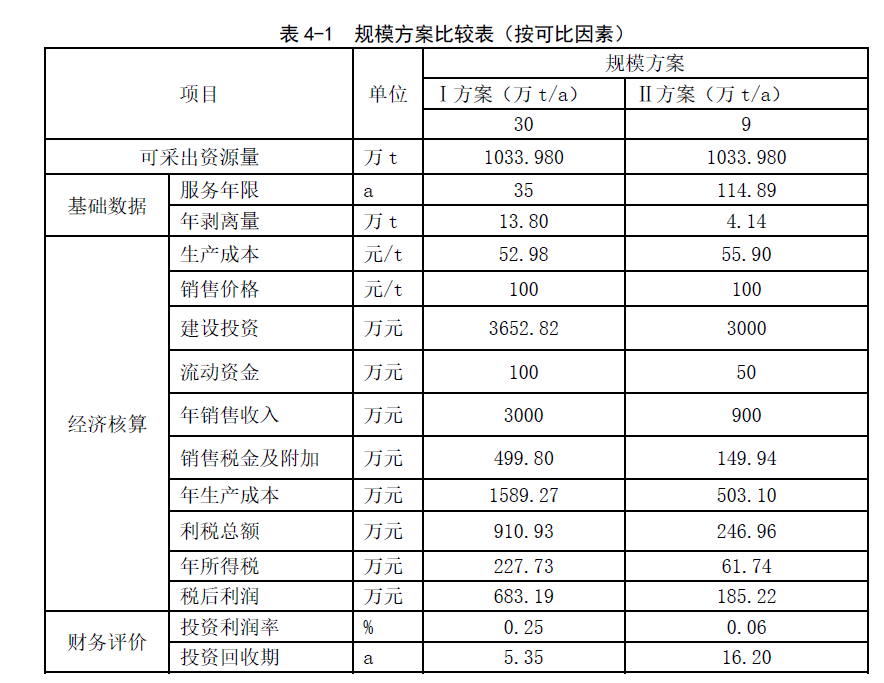

According to the three-in-one plan for silica mines published by a silicon metal plant in north-west China in 2024, the production cost of silica is relatively low. Although the current price of silica per mt mostly falls within the price range of 200-400 yuan/mt, the overall profit margin remains relatively sufficient compared to production costs. While demand for silica from the silicon metal channel has not been particularly strong recently, mines have shown a strong stance on standing firm on quotes, with little enthusiasm for price reductions. Additionally, due to its relatively low value and small cost proportion in silicon metal smelting, silicon metal manufacturers are relatively flexible in accepting silica prices. Overall, although silica prices have shown only slight loosening in recent years, considering the increasing resource supply and the potential lack of significant recovery in demand, prices may still have room for further loosening.

![Before the holiday, the black chain is unlikely to see a trend-driven market [SMM Steel Industry Chain Weekly Report].](https://imgqn.smm.cn/usercenter/zUFfM20251217171748.jpg)

![[SMM Chromium Daily Review] Inquiries and Transactions Weakened, Chromium Market Showed Mediocre Performance Before the Holiday](https://imgqn.smm.cn/usercenter/ENDOs20251217171718.jpg)